The 6-Minute Rule for Estate Planning Attorney

The 6-Minute Rule for Estate Planning Attorney

Blog Article

The Main Principles Of Estate Planning Attorney

Table of ContentsEstate Planning Attorney - The FactsThe Definitive Guide to Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.Some Known Questions About Estate Planning Attorney.

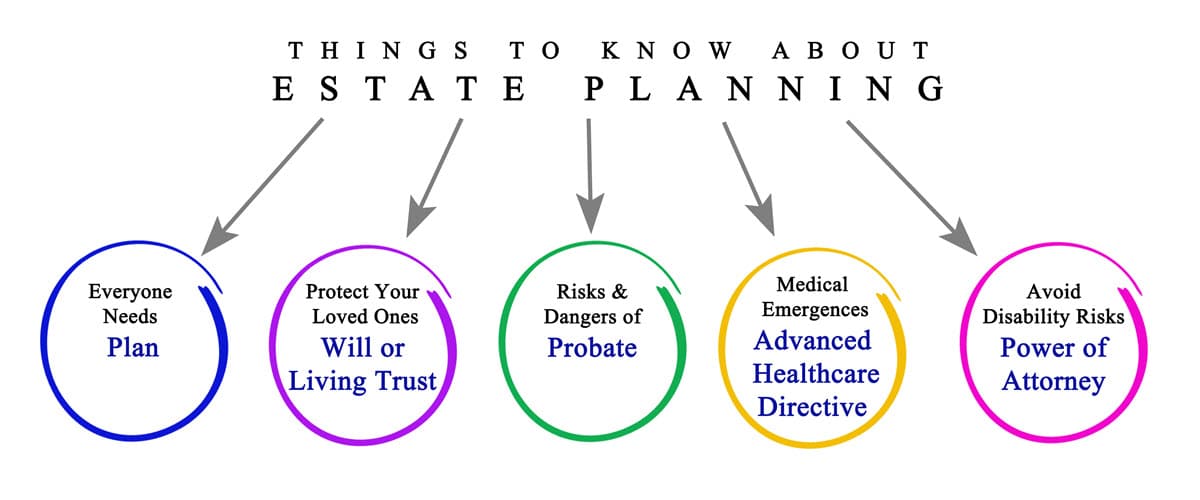

Estate planning is an activity plan you can make use of to identify what takes place to your properties and commitments while you're to life and after you pass away. A will, on the other hand, is a lawful record that outlines just how properties are dispersed, who takes treatment of kids and pets, and any kind of various other wishes after you pass away.

Claims that are turned down by the executor can be taken to court where a probate court will have the last say as to whether or not the insurance claim is valid.

Get This Report about Estate Planning Attorney

After the inventory of the estate has been taken, the worth of properties computed, and tax obligations and financial debt paid off, the executor will certainly then look for permission from the court to distribute whatever is left of the estate to the recipients. Any type of estate taxes that are pending will come due within nine months of the day of death.

Each individual locations their assets in the count on and names someone other than their spouse as the recipient., to support grandchildrens' education and learning.

Some Known Facts About Estate Planning Attorney.

Estate coordinators can work with the contributor in order to decrease taxable earnings as a result of those contributions or develop approaches that optimize the impact of those contributions. This is one more method that can be utilized to limit death tax obligations. It entails a specific locking in the present value, and thus tax liability, of their building, while associating the value of future development of that capital to an additional person. This approach includes cold the worth of an asset at its value on the day of transfer. As necessary, the amount of possible capital gain at death is likewise frozen, allowing the estate planner to approximate their potential tax obligation obligation upon fatality and better plan for the settlement of income tax obligations.

If adequate insurance policy profits are available and the policies are appropriately structured, any kind of earnings tax on the considered personalities of assets following the fatality of an individual can be paid without considering the sale of possessions. Proceeds from life insurance policy that are received by the recipients why not find out more upon the discover this death of the guaranteed are typically revenue tax-free.

Various other costs connected with estate planning include the prep work of a will, which can be as reduced as a couple of hundred dollars if you use one of the finest online will certainly manufacturers. There are certain records you'll need as component of the estate preparation procedure - Estate Planning Attorney. Some of the most usual ones include wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a myth that estate preparation is just for high-net-worth individuals. That's not real. Actually, estate preparation is a tool that every person can use. Estate intending makes it less complicated for people to determine their desires prior to and after they pass away. As opposed to what the majority of people believe, it expands past what to do with assets and obligations.

The Single Strategy To Use For Estate Planning Attorney

You must start planning for your estate as quickly as you have any kind of measurable asset base. It's a continuous procedure: as life proceeds, your estate strategy need to change to match your circumstances, in line with your brand-new objectives.

Estate planning is commonly thought of as a tool for the wealthy. Estate preparation is additionally an excellent way for you to lay out plans for the treatment of your small kids and pets and to outline your dreams for your funeral service and favored charities.

Applications need to be. Qualified candidates that pass the examination will go now be officially certified in August. If you're eligible to sit for the exam from a previous application, you might file the brief application. According to the policies, no accreditation shall last for a duration much longer than five years. Discover out when your recertification application is due.

Report this page